Mexico’s General Elections: Continuity likely but headwinds ahead

KEY POINTS

Big vote, big challenges

Anticipation is mounting for Mexico’s general elections on 2 June as citizens will cast their votes for a new president and legislature, as well as for numerous local government officials. Despite high approval ratings, incumbent President Andrés Manuel López Obrador (better known as AMLO) cannot seek re-election under the country’s rules, limiting the head of state to one six-year term. The incoming president is scheduled to take office on December 1, and given current polling, we could see the election usher in Mexico’s first female leader. These elections will be nothing short of monumental, with over 20,000 positions up for grabs, including 628 seats in Congress, 128 senators, and 500 federal deputies. Overall, it signals that there will be significant changes to Mexico's political landscape. Amid pressing issues, such as the state of the energy sector, nearshoring, and the forthcoming United States-Mexico-Canada Agreement (USMCA) review in 2026, the outcome could hold profound implications. Additionally, with both the U.S. and Mexican presidential elections coinciding for the first time in over a decade, the interplay between these two nations adds complexity to this crucial electoral cycle.

Adiós Presidente, hola Presidenta

Below we list the presidential election’s main candidates and outline their key policies:

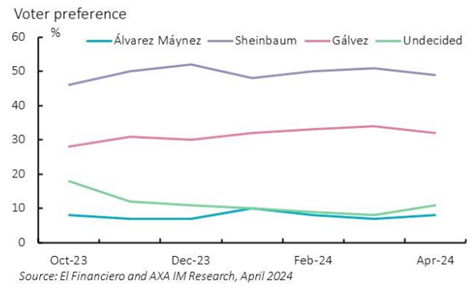

Claudia Sheinbaum, former Mayor of Mexico City (2018-2023) and candidate of the ruling Morena party, enjoys a comfortable lead in the race – 49% of support, according to an El Financiero newspaper poll (Exhibit 1). Sheinbaum's candidacy is buoyed by the Seguimos Haciendo Historia coalition she spearheads, which includes the Workers’ Party and the Green Party. Sheinbaum's popularity is further bolstered by the enduring support of the incumbent, President AMLO, Mexico's first left-wing leader, who maintains a strong public approval rating after nearly six years in office.

Exhibit 1: Two women lead the presidential race

Sheinbaum is running on a platform of continuity of AMLO’s popular legacy. On the economic front, Sheinbaum wants to maintain fiscal discipline, uphold the central bank’s autonomy, and ensure public debt stability. Although she has not yet proposed tax reform, she has highlighted the need to fight tax evasion. Sheinbaum's pension system proposals aim to ensure retirees' financial security by advocating for current policies, such as increasing contributions, reducing eligibility requirements, and supporting the creation of the “Pension Fund for Wellbeing.” Additionally, Sheinbaum's energy policies emphasize continued support for state energy companies like Petróleos Mexicanos (Pemex) and Comisión Federal de Electricidad (CFE), with a focus on oil refining and renewable energy development.

Former senator Xóchitl Gálvez is Sheinbaum’s primary challenger, commanding 32% of the vote according to polls. She leads the Fuerza y Corazón coalition, which brings together historical adversaries: the National Action Party (PAN), the Institutional Revolutionary Party (PRI), and the Party of the Democratic Revolution (PRD). In the 2018 presidential election, these parties failed to unite, ultimately contributing to AMLO's presidential victory.

In terms of policy, Gálvez advocates for a decentralized economic model where the private sector plays a key role in investment. She proposes tax reforms to ease the burden on small and medium-sized enterprises and emphasizes protecting autonomous regulatory bodies. She also wants to boost infrastructure investment through public-private partnerships and streamline permits for energy production, particularly in renewables. She pledges to uphold existing social welfare programs while bolstering support for vulnerable populations by proposing a lower retirement age and improved healthcare access. However, she has not specified how this pension reform would be financed.

Jorge Álvarez Máynez, currently serving his second term in Mexico's Chambers of Deputies, entered the presidential race in January after his party’s initial candidate, Nuevo León governor Samuel García, withdrew. Positioned as a potential “third way” option, Álvarez Máynez is targeting anti-establishment voters with promises of political reform. However, according to polls, he is in third position and quite some way behind Sheinbaum and Gálvez, and the outcome of his candidacy may chiefly be to bolster his party's visibility and up its representation in Congress. He advocates for increased public investment to improve infrastructure, to transform state-owned energy companies to promote renewable energy, and supports decriminalizing drugs to boost revenue. Additionally, his “National Pacification Plan” focuses on creating more police academies and ending militarization.

Winning the crown, missing the court

Barring a significant electoral upset, polls strongly indicate a Sheinbaum victory. Her triumph would signify a historic milestone as Mexico’s first female leader and would further solidify Morena’s hold over the country. The ruling party currently holds a simple majority in both chambers of Congress and controls most governorships, yet attaining a supermajority seems improbable in the legislative elections.

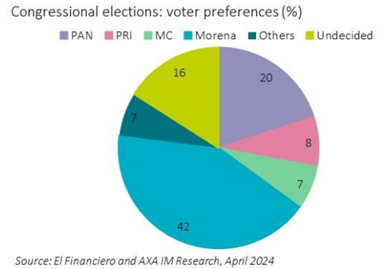

Despite AMLO’s strong 70% approval rating, his efforts to enact constitutional reforms have been hampered by Morena’s (and its allies) shortfall in Congress. With all lower house seats and 128 upper house seats up for grabs, June’s elections take on added significance. Polls show 42% support for Morena, 20% for PAN, 8% for PRI (Exhibit 2), 7% for Movimiento Ciudadano, and 7% for all other parties. However, a significant 16% of voters remain undecided. With this level of support, Morena will again likely lack the supermajority needed for constitutional reforms. As such, a Sheinbaum administration may encounter similar legislative obstacles to AMLO’s presidency.

Exhibit 2: A bittersweet congressional victory?

Even if Sheinbaum secures a supermajority – contrary to current poll predictions – and consolidates her party's control, there will be no room for complacency. Mexico needs to leverage global geopolitical tensions to increase its appeal for nearshoring activities if it wants to boost its relatively low potential GDP growth. In this context, the upcoming USMCA review in 2026 will be crucial, though its outcome remains uncertain, particularly if Donald Trump were to be re-elected as U.S. president. In addition, Mexico also needs to revitalize its aging energy sector to ensure affordable energy provision to its large industrial sector, making it more attractive for foreign companies to invest in the country. In the following sections, we delve deeper into these themes, highlighting the challenges awaiting Mexico’s next president.

Another kind of power struggle

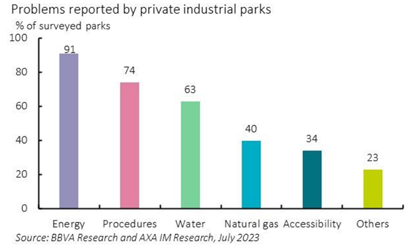

Years of infrastructure investment neglect have exacerbated the challenges Mexico's industrial sector faces, with energy emerging as a critical concern. A 2023 survey revealed that over 90% of private industrial parks encountered issues with reliable electricity (Exhibit 3), reflecting the repercussions of the sector's heavy reliance on oil, which accounts for approximately 43% of primary energy consumption.

Exhibit 3: Issues faced by the industrial sector

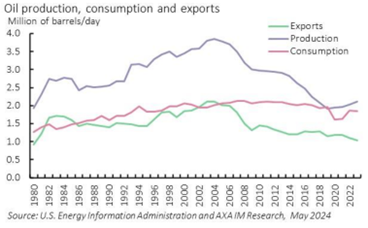

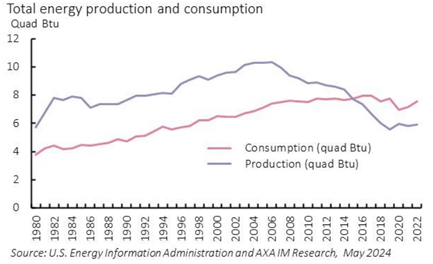

The oil industry has historically been a very important sector in Mexico. From 1979 to 2002 Mexico was among the top five global oil producers, and until a few years ago, oil-related revenues represented around one-third of total public revenue. However, oil output began to fall in 2004 as the country’s largest oil field started to deplete (Exhibit 4).

Exhibit 4: Dwindling oil industry

To revitalize the ailing industry, the previous administration approved an ambitious energy reform in 2014, allowing private investment in both the oil and electricity sectors, while putting an end to the 75-year-old monopolies held by the two state-owned giants, oil company Pemex and utility company CFE.

However, since taking office, AMLO has consistently worked to dismantle this reform, claiming the country’s dependence on large imports of refined oil products like gasoline and diesel is the result of a so-called energy sovereignty crisis. The government has canceled oil field auctions, renegotiated pipeline contracts, and imposed barriers to entry to new renewable energy providers. Likewise, it has tried for years to grant full control of the electricity sector to CFE. Should these trends – aimed at bolstering the state's hold over the energy sector – persist under a Sheinbaum administration, they would likely prove detrimental to Mexico's long-term energy requirements and could deter foreign companies from investing if they lack access to affordable energy. Indeed, Mexico is already a net energy importer, consuming more energy than it produces (Exhibit 5). According to the International Monetary Fund, the country’s energy demands are unlikely to be met without private sector investment and expertise, particularly given the substantial debts of state-owned enterprises.

Meanwhile Sheinbaum’s energy plans are somewhat contradictory. While her 2024-2030 roadmap calls for the rapid decarbonization of the energy matrix, the same document indicates that her government would uphold AMLO's energy policy of striving for energy self-sufficiency by bolstering Pemex and acquiring more refineries, without mentioning a commitment to achieving net zero emissions. Sheinbaum has also stated intentions to invest over US$13bn (0.7% of GDP) through 2030 in renewable energy.

Exhibit 5: Energy deficit

USMCA review in 2026

The certainty provided by USMCA’s rules and the persistent efforts of the U.S., Mexico, and Canada to implement the agreement effectively since its July 2020 start have been important in North America’s impressive trade growth of over 36% since the trade agreement’s inception. However, the agreement’s upcoming review in 2026 introduces uncertainty for business communities in all three countries. If the parties do not extend the deal at the first joint review in 2026, there will be a review each year for the remainder of the agreement’s term (until 2036). In these subsequent joint reviews, the parties may reaffirm their wish to extend the agreement for another 16 years. However, failure to extend the agreement during any of the reviews would result in the end of the trade deal in 2036.

Presidential elections in Mexico and, more notably, in the U.S., could potentially shape the agreement's future, introducing additional uncertainty. Despite occasional nationalist rhetoric, AMLO's actions reflect his government's continued commitment to upholding U.S. interests in Mexico. It seems likely Sheinbaum will adopt a similar stance and advocate for the continuation of the USMCA, especially given Mexico's heavy reliance on the U.S. market for its exports. However, it is important to acknowledge that under a Sheinbaum administration, the range of contentious issues related to the agreement is likely to be more extensive compared to one led by Gálvez, potentially complicating negotiations and implementation.

Proximity = Prosperity?

The continued success of the USMCA will be pivotal in advancing nearshoring efforts in Mexico. In a previous note, we outlined key drivers behind the shift of supply chains to Mexico, such as trade redirection from China amid the U.S.-China trade war, amplified by USMCA's duty-free access. Additionally, pandemic-era disruptions have spurred demand for resilient supply chains, prompting a focus on production in proximity to the end consumer. Moreover, U.S. President Joe Biden’s administration has echoed the importance of making supply chains more resilient, highlighting Mexico and Canada's significant roles in this endeavor. Mexico's competitive advantages, including low wages and transportation costs due to its proximity to the U.S., further solidify its appeal as a manufacturing destination.

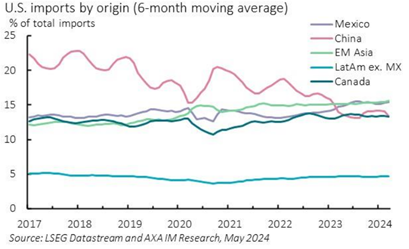

Since 2018, amid escalating trade tensions between the U.S. and China, Mexico has seen an uptick in its share of U.S. imports to 15.6% in 2024 from 13% in 2018. Meanwhile, China's share has decreased to 13.5% from 22.8% over the same period (Exhibit 6). However, these figures highlight that Mexico has not fully seized the opportunity presented by China's reduced share, as other Asian countries emerge as formidable competitors in the reshoring landscape. Specifically, as a region, emerging markets in Asia have expanded their share from 11% to 15.7% since 2018. Nevertheless, it's worth noting that Mexico remains the primary individual country of import origin for the U.S., after it surpassed China in early 2023.

Exhibit 6: Share in U.S. imports

Likewise, another potential bellwether for nearshoring activities are foreign direct investment (FDI) inflows. These investments often precede the establishment of manufacturing operations in a country, indicating longer-term commitment from companies seeking to relocate production. However, if anything, gross FDI inflows to Mexico have been losing steam since mid-2022 and currently amount to only 2% of GDP. Meanwhile, FDI inflows have picked up in other Latin American countries (Exhibit 7).

Sheinbaum holds a favorable stance on nearshoring, emphasizing that investments should be in harmony with the nation's energy policy, provide high-quality employment opportunities, uphold local community interests, and adhere to rigorous decarbonization criteria. She prioritizes sectors such as semiconductors, electronics, electromobility, medical devices, and agro-industry, aiming to capitalize on the distinctive strengths of various regions across Mexico and organize them into industrial corridors. Nonetheless, while Sheinbaum advocates for nearshoring, her efforts might be hindered by Morena's occasional nationalist and anti-business rhetoric, along with the party's failure to address the energy sector's issues. In contrast, Gálvez's more pro-business stance suggests potential for stronger nearshoring under her administration.

Exhibit 7: FDI inflows losing steam in recent years

A slowing growth outlook, Mexico's forthcoming general elections are expected to maintain continuity within the political landscape, with the anticipated election of Claudia Sheinbaum from the ruling Morena party. However, challenges lie ahead as Sheinbaum may lack a supermajority in Congress, potentially hindering significant constitutional reforms. Nevertheless, these elections also present an opportunity to address pressing economic issues such as revitalizing the energy sector, strategic leveraging of nearshoring opportunities, and the upcoming review of the USMCA. Moreover, the outcome of the U.S. elections could add another layer of complexity to the political landscape.

If Claudia Sheinbaum is successful in the presidential race, her administration's continuation of AMLO’s policies is likely to have several positive implications for investors. Her commitment to fiscal discipline and public debt stability could provide a stable economic environment, appealing to bond investors. Additionally, her focus on renewable energy investment may present significant opportunities in the green energy sector, potentially attracting investors interested in sustainable and environmentally friendly projects.

Regarding Mexico’s growth outlook, we expect GDP growth to slow to 2.2% in 2024, from 3.0% last year, despite increased public spending ahead of June’s elections. Already, growth has dipped to 1.6% year-on-year in the first quarter (Q1), the slowest since Q1 2021. Looking ahead, significant headwinds loom, including from high interest rates and a decline in remittances in pesos, reflecting the local currency's strength. Nevertheless, there are bright spots as well, such as stable credit flows, a resilient job market, and easing inflation. As we look towards 2025, growth should further ease to 2.1%. However, this figure remains contingent upon several factors, notably the next president's capacity to attract foreign investment, which in part relies on effective collaboration with the U.S. government ahead of the 2026 USMCA review.

Disclaimer

Este documento ha sido emitido por AXA IM México, S.A. de C.V., (“AXA IM Mexico”) un asesor financiero independiente constituido de conformidad con la Ley del Mercado de Valores. La información aquí contenida es consistente con las disposiciones contenidas en el artículo 6 de la Ley del Mercado de Valores, de conformidad con las disposiciones del Artículo 226, Sección VIII del mismo ordenamiento legal.

Este documento y la información contenida en este documento están diseñados para el uso exclusivo de clientes sofisticados o inversionistas institucionales y/o calificados y no debe ser dirigido hacia clientes minoristas o inversionistas particulares. Ha sido preparado y publicado con fines informativos únicamente a solicitud exclusiva de los destinatarios especificados y no destinado a la circulación general entre el público inversionista. Es estrictamente confidencial y no se debe reproducir, distribuir, circular, redistribuir ni utilizar de otra manera, total o parcialmente, de ninguna manera sin el consentimiento previo por escrito de AXA IM Mexico. No está destinado a ser distribuido a ninguna persona o jurisdicción para la que esté prohibido.

En la medida de lo permitido por la ley, AXA IM Mexico no garantiza la exactitud o idoneidad de cualquier información contenida en este documento y no asume responsabilidad alguna por errores o declaraciones erróneas, ya sea por negligencia o cualquier otra razón. Dicha información puede estar sujeta a cambios sin previo aviso. Los datos contenidos en este documento, incluyendo pero no limitado a cualquier backtesting, historial de desempeño simulado, análisis de escenarios e instrucciones de inversión, se basan en una serie de supuestos e insumos clave y se presentan con fines indicativos y / o ilustrativos solamente.

Este documento ha sido preparado sin tener en cuenta las circunstancias personales específicas, los objetivos de inversión, la situación financiera o las necesidades particulares de persona alguna en particular. Nada de lo contenido en este documento constituirá una oferta para entrar o un término o condición de cualquier negocio, transacción, contrato o acuerdo con el receptor del mismo o con cualquier otra parte. Este documento no se considerará como asesoría en inversión, asesoría fiscal o legal, ni una oferta de venta o solicitud de inversión en un fondo en particular. Si no está seguro del significado de cualquier información contenida en este documento, consulte a su asesor financiero u otro asesor profesional. Los datos, las proyecciones, los pronósticos, las previsiones, las hipótesis y / o las opiniones aquí vertidas son subjetivos y no son necesariamente utilizados o seguidos por AXA IM Mexico o sus compañías afiliadas que pueden actuar basándose en sus propias opiniones y como áreas independientes dentro de la organización.

Toda actividad de inversión conlleva riesgos. Debe tener en cuenta que las inversiones pueden aumentar o disminuir en valor y que el rendimiento pasado no es garantía de rentabilidades futuras, es posible que no reciba la cantidad inicialmente invertida. Los inversores no deben tomar ninguna decisión de inversión basada únicamente en este material.

Si algún fondo se destaca de manera particular en esta comunicación (el "Fondo"), su documento de oferta, prospecto de inversión o documento de información clave contiene información importante sobre restricciones de venta y factores de riesgo, debe leerlos cuidadosamente antes de realizar cualquier transacción. Es su responsabilidad conocer y observar todas las leyes y reglamentos aplicables de cualquier jurisdicción pertinente. AXA IM Mexico no tiene intención de ofrecer ningún Fondo en ningún país donde dicha oferta esté prohibida.

Para conocer la totalidad de los riesgos asociados, lea cuidadosamente el prospecto y/o el folleto de información clave del fondo.

AXA IM México, S.A. de C.V. está inscrita en el Registro Público de Asesores en Inversiones con número de folio 30054-001-(14084)-20/05/2016, asignado por la Comisión Nacional Bancaria y de Valores. Al respecto, la Comisión Nacional Bancaria y de Valores supervisa exclusivamente la prestación de servicios de administración de cartera de valores cuando se tomen decisiones de inversión a nombre y por cuenta de terceros, así como los servicios consistentes en otorgar asesoría de inversión en Valores, análisis y emisión de recomendaciones de inversión de manera individualizada, por lo que dicha Comisión Nacional Bancaria y de Valores carece de atribuciones para supervisar o regular cualquier otro servicio que AXA IM México pueda proporcionar a sus clientes. La inscripción en el Registro Público de Asesores en Inversiones que lleva la Comisión Nacional Bancaria y de Valores en términos de la Ley del Mercado de Valores, no implica el apego de AXA IM México a las disposiciones aplicables en los servicios prestados, ni la exactitud o veracidad de la información proporcionada.

AXA IM México, S.A. de C.V. conforme a la Ley del Mercado de Valores, tiene prohibido garantizar rendimientos a sus clientes sobre sus inversiones, así como recibir en depósito o custodia dinero o valores de sus clientes.

Asimismo, AXA IM México no percibe remuneraciones de parte de emisoras o personas relacionadas por la promoción de valores, ni de intermediarios del mercado de valores, nacionales o del extranjero.